can you pay california state taxes in installments

Yes it is possible to pay taxes in installments. You can also make government tax payments by calling ACI Payments Inc at 1-800-2PAYTAX 1-800.

Irs Notice Cp523 Intent To Terminate Your Installment Agreement H R Block

Under a Guaranteed Installment Agreement there is no minimum monthly payment as long as you pledge to pay off your balance within three years.

. You may qualify to pay your tax in. By completing Form FTB 3567 and sending it to the State of California Franchise Tax Board PO. The Department will not extend payment dates related to trust fund taxes.

In order to qualify you must. Ad End IRS State Tax Problems. To avoid interest charges you must pay tax instalments totalling the lesser of a your tax owing for the year or b what CRA requested of you.

If you are unable to pay your state taxes you can apply for an installment. Generally taxpayers can avoid paying california penalties for underpayment of estimated taxes by paying the lesser of the following. In fact if a taxpayer owing less than 10000 can pay the balance in full within a three-year period the IRS will generally approve an installment.

Box 2952 Sacramento CA 95812-2952. If you cant pay your tax bill in 90 days and want to get on a payment plan you can apply for an installment agreement. Remember under California law the tax payer is responsible for paying all tax bills on time and mailing them to the address specifiedThe first installment is due on November 1.

By completing Form FTB 3567 and sending it to the State of California Franchise Tax Board PO. If you are unable to pay your state taxes you can apply for an installment agreement. Take Advantage of Fresh Start Options.

It may take up to 60 days to process your request. First-quarter property tax bills are mailed out on October 1st. Free Consult 30 Second Quote.

In order to pay property taxes two payments must be made. Affordable Reliable Services. The requested tax instalment.

Can You Pay California State Taxes in Installments Posted by nedko on February 2 2022 in Uncategorized Yes California offers taxpayers the option to set up a California tax. I have installments set up for my federal taxes but I did not see an option for California state taxes. Franchise Tax Board State of California Installment Agreement Request We will always ask you to immediately pay your tax liability including interest and penalties in full.

Payment is due by November 1st and debt is deemed. Usually you can have from three to five years to pay off your taxes with a state installment. An application fee of 34 will be added.

Second Installment Payments For 2019 20 Secured Property Tax Bills Are Due February 1st County Of San Luis Obispo

Property Tax Prorations Case Escrow

Irs Letter 4458c Second Installment Agreement Skip H R Block

Supplemental Secured Property Tax Bill Placer County Ca

Due Dates For San Francisco Gross Receipts Tax

The Easy Guide To Making Estimated Tax Payments Nest Payroll

How To Pay Your Taxes With A Credit Card In 2022 Forbes Advisor

How A 390 459 Irs Debt Reached A 94 Settlement Landmark Tax Group

Can I Pay Taxes In Installments

New Program Allows Taxpayers Pay Annual Property Taxes In Monthly Installments County Of San Luis Obispo

:max_bytes(150000):strip_icc()/9465-700bb91065234917b8d2866f2306afe9.jpg)

Form 9465 Installment Agreement Request Definition

:max_bytes(150000):strip_icc()/ScreenShot2021-02-10at11.00.22AM-1f51d54182cb40b0b110e0940688fbb8.png)

Form 6252 Installment Sale Income Definition

Lease And Buy Agreement Real Estate Forms Real Estate Business Template

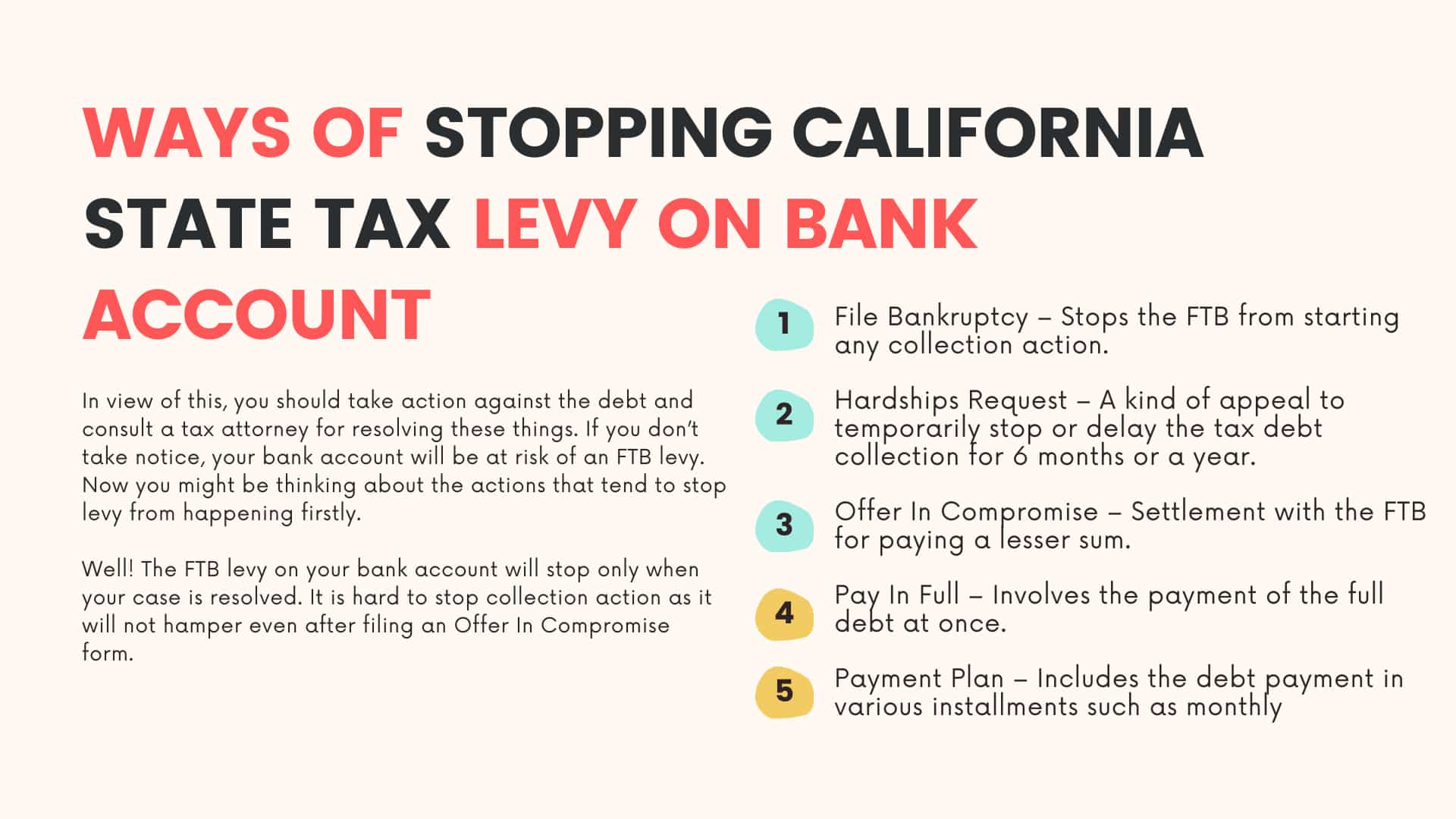

3 Proven Ways To Stop California State Tax Levy On Bank Account

San Jose 1886 Old Map Reprint Advertising On Edges Etsy Old Map Old Maps California City

Secured Property Taxes Treasurer Tax Collector

Annual Secured Property Tax Bill Los Angeles County Property Tax Portal